Fees and costs structure

No one likes hidden fees and costs, that’s why at AMP, we work hard to keep our fees competitive - meaning more money for you in retirement! Our industry - beating fee structure include administration, investment (with transaction costs), and other member-related services so you know exactly where your money goes.

Ongoing fees and costs

Admin

$ based fee

+

% based fees & costs

+ Investment

(incl. transaction costs)

% based fees & costs

+ Other member related fees & costs

If applicable – advice fees for personal advice, insurance fees, and transaction cost allowance

For more information please refer to the Product Disclosure Statement (PDS).

Admin fees and costs

Administration fees cover the general running of your super fund. These fees do not cover costs like investment fees or other fees related to specific member activities (such as advice fees for personal advice, insurance fees, or transaction cost allowances, if these apply). You can see our standard administration fees below. If you are part of an employer plan, you may receive discounts on some of these fees. For more information please refer to the Product Disclosure Statement (PDS) and Member Guide.

Dollar fee

-

Per week

$ 1.50

+ Percentage fees & costs

-

Up to a maximum of $950 p.a.

0.19 %

-

trustee fee

0.015 %

+ Super fund’s assets

-

Paid from the super fund’s assets and not deducted from your account

0.049 %

See how your fees stack up

If you have $50,000 invested in an AMP MySuper 1970s account, here’s what your annual fees could look like:

Admin fees and costs

-

($1.50 p.w.)

$ 78+

-

(0.19% per annum + 0.015% per annum^^ + 0.049% per annum**)

$ 127

Fees & costs (dollar + percentage)

+ Investment fees & costs

-

(0.47% per annum)

$ 235

-

(0.05% per annum)

$ 25

Above represents fees and costs (inc. performance fees) + transaction costs

= Cost of product

-

$ 465 P.A.

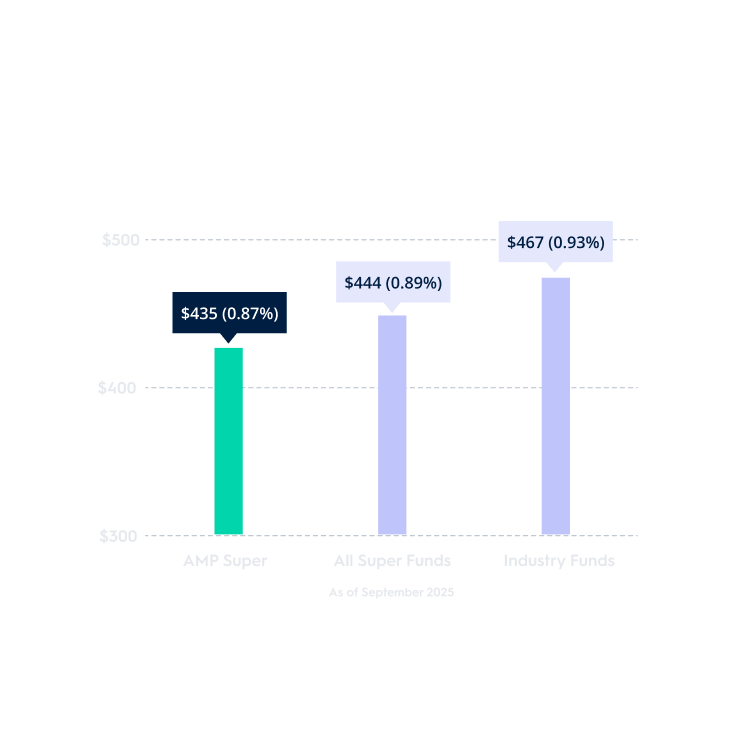

AMP MySuper fees are lower than both the average super fund and the average industry fund¹.

AMP MySuper lifestages

AMP MySuper Lifestages takes the hard work out of deciding how to invest your super by providing a simple single investment option tailored for your age group. If you join through your employer, you’ll be invested in AMP MySuper Lifestages as an AMP Super member unless you make an alternative investment choice.

AMP MySuper Lifestages matches the decade you were born and takes you all the way through your super savings journey, continuously evolving.

| Investment option | Total estimated inv fees & costs (incl transaction costs) |

| 1990s Plus | 0.51% |

| 1980s | 0.51% |

| 1970s | 0.52% |

| 1960s | 0.48% |

| 1950s | 0.37% |

| Cap Stable | 0.37% |

Multi-Sector Investment Options

These are investment options available across different risk profiles e.g. Balanced, Growth, High Growth. Multi-sector investment options are available with active management (via the Future Directions range) as well as options that aim to closely track the returns of a market index before fees and tax (via the index range).

| Investment option | Total estimated inv fees & costs (incl transaction costs) |

| Balanced index | 0.23% |

| Future Directions Balanced | 0.69% |

Single-Sector Investment Options

These are investment options focused on specific assets classes e.g. Australian shares, international shares, and property, fixed interest. Single-sector investment options are also available with active management (via the Specialist range) as well as options that aim to closely track the returns of a market index before fees and tax (via the index range).

| Investment option | Total estimated inv fees & costs (incl transaction costs) |

| Australian Share Index | 0.16% |

| Specialist Australian Share | 0.91% |

| International Share Index | 0.16% |

| Specialist International Share | 0.68% |

Want to understand our other options?

We offer around 30 investment options, and members can choose up to 15 different options from the standard investment menu to build their portfolio. Download the Investment Guide if you want to understand more about all options you can access.

Smart fee features that put you first

Smart fee features that put you first

For more information please refer to the Product Disclosure Statement (PDS) and Member Guide.

As well as strong returns and low fees, members also get

Simple advice and super coaches

We want you to get super close to your super. That’s why we have a range of advice choices with no extra fees.

Digital tools and calculators

From the Investment Risk Profiler to the Retirement Needs Calculator, you can explore and play out your future today.

Frequently asked questions

AMP Super caps the percentage-based administration fee on your account at $950 per year. This means that regardless of how much your balance grows, you won’t pay more than $950 per annum in this administration fee. Learn more in the AMP Super Product Disclosure Statement (PDS) or Member Guide.

In addition to the administration fees and costs, other fees and costs may apply depending on your chosen features, such as investment fees and costs, insurance fees, and advice fees. Some employer plans may also have negotiated lower fees. For full details, please refer to the PDS and Member Guide.

Investment fees and costs including transaction costs vary depending on your selected investment option. For example, AMP MySuper Lifestages options generally range from 0.37% to 0.52% per annum. You can find a breakdown of fees for each investment option in the Investment Guide.

No, if you have linked super and allocated pension accounts in AMP Super, you’ll only be charged the member fee once. For more information, please see the PDS and Member Guide.

If you have super accounts with multiple funds, you may be paying multiple sets of fees. Consider consolidating your super into one account using AMP’s online super consolidation tool via My AMP. Learn more about consolidation options in the PDS.

A trustee fee applies to your account balance to cover the costs incurred by the trustee in managing the AMP Super Fund.

Superannuation trustees may establish and hold assets in addition to member account balances to manage the Fund’s risks (for example, administration and/or operational risk). As a member of AMP Super, a portion of the administration fees and costs is met from these assets and not deducted from your account.

Fees and costs encompass all charges affecting a member’s balance.

“Fees” are amounts charged by a service provider (like AMP) for administering or managing your superannuation investments. These are determined after factoring in the costs incurred by the fund. For example, administration fees and investment fees.

“Costs” are broader than fees and refer to expenses incurred either directly or indirectly in administering or managing your superannuation investments. These include all expenses incurred in operating the superannuation product. For example, other investment costs and transaction costs.

Important information

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

Credit and deposit products are issued by AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. Any application is subject to AMP Bank’s approval.

Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant Product Disclosure Statement and Target Market Determination from AMP at amp.com.au or by calling 131 267.

Read AMP’s Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

Any advice and information provided is general in nature, hasn’t taken your circumstances into account, and is provided by AWM Services Pty Ltd ABN 15 139 353 496 AFSL 366121 (AWM Services), which is part of the AMP group (AMP). All information on this website is subject to change without notice.

The super coach session is a super health check and is provided by AWM Services. It is general advice conversation only. It does not consider your personal circumstances.

The retirement health check is a general advice conversation only, provided by AWM Services to eligible members of the AMP Super Fund.

Simple Super (Intrafund) advice is provided by AWM Services Limited (AWM Services) ABN 15 139 353 496, AFS Licence No. 366121 (AWMS) to eligible members of the AMP Super Fund. AWM Services is a wholly-owned subsidiary of AMP. This service may not be offered where it is deemed it is not within the scope of the service or your best interest.

Footnotes

*AMP MySuper Lifestages investment options are based on your decade of birth and take you through your working life, continuously evolving as you approach retirement. AMP MySuper 1970s, 1980s, or 1990s Plus investment options delivered an average return of 10.89% for the year to 31 December 2025. *Past performance is not a reliable indicator of future performance. Investment performance is as at 31 December 2025 and is net of investment fees, costs and tax (but excludes administration fees, trustee fees, member fees, amounts paid from the super fund’s assets and member activity fees).

**This is paid from fund assets and not deducted from your account.

1Based on the simple average of total administration and investment fees and costs across all AMP MySuper Lifestages options (Capital Stable, 1950s, 1960s, 1970s, 1980s, 1990s Plus). Compared against the simple average of all super funds’ MySuper options included in the Chant West Super Fund Fee Survey September 2025 at balances of $50,000 to $750,000.

2If a member holds more than one account, a separate percentage administration fee cap will apply to each account held by the member. For more information, please refer to the product disclosure statement.

3This is illustrative only and isn’t an estimate of the investment returns you’ll receive or fees and costs you’ll incur. Past performance is not a reliable indicator of future performance.

^Eligibility criteria apply. See the Member Guide for full details before enjoying the Temporary Pension Administration Fee Holiday.

^^This is the trustee fee deducted from your account in addition to percentage admin fees.