Key takeaways

- Learn what the Australian standard is for retirement in Australia and how you compare

- Retirement income needs vary by lifestyle, housing and retirement length

- Retirement funds can come from superannuation, the age pension, investments and savings

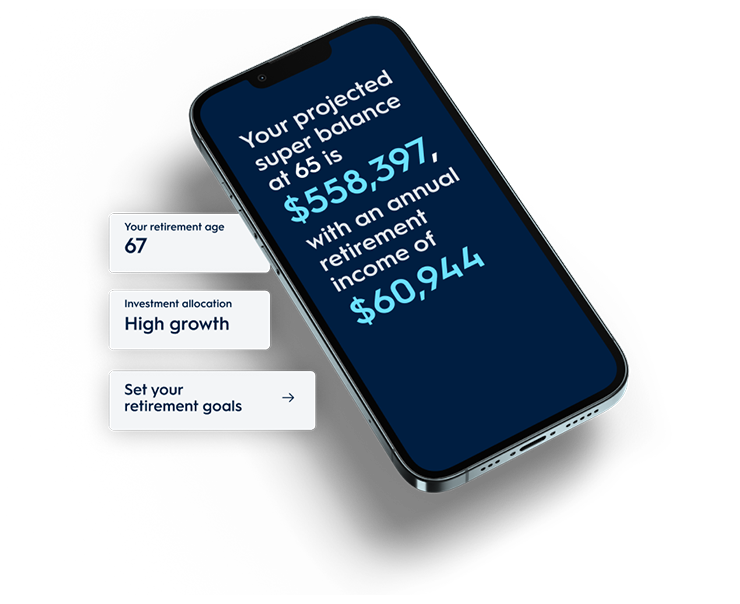

- Use AMP’s Retirement Needs Calculator and Retirement Simulator tools to estimate how much you’ll need to retire comfortably and how much you’ll have in retirement

Estimate your retirement needs – easily

Whether your ideal retirement means long lunches with friends, exploring new places or simply enjoying more free time, the first step is knowing how much you’ll need to make it all happen.

Working out how much is enough for retirement depends on many factors, such as your lifestyle, plans for the future, and the number of years you’ll spend retired. Additionally, estimating how much you’ll have when you plan to retire depends on factors such as your current salary, super balance and assets. It’s a concern shared by many – in fact, recent AMP research shows that two in three (68%) Aussies under 40 say they need more wealth to feel financially confident about retirement, while less than one in 12 (8%) feel financially secure and independent1.

Read on to see what the standard retirement looks like in Australia, and how you can estimate how much you’ll need and have with our calculator tools.

How much is actually enough for retirement?

There’s no magic number for everyone, and the amount you need to live comfortably in retirement depends on a range of factors, such as your expenses, any outstanding debts you might have and whether you have access to other forms of income like investments, savings, an inheritance, or the government's Age Pension, which not everyone will be eligible for. To give you a starting point, we calculated the total superannuation balances needed to reflect the minimum required capital at retirement at age 67:

| Comfortable lifestyle (homeowner) | Modest lifestyle (homeowner) | Modest lifestyle (renter) | |

| Single | $430,000 | <$50,000 (minimal as most is expected to be funded by Age Pension) | $300,000 |

| Couple | $500,000 | <$50,000 (minimal as most is expected to be funded by Age Pension) | $330,000 |

Note: The total superannuation balances needed were calculated to reflect the minimum required capital at retirement to meet living cost for each lifestyle up to the 1 in 5 retirement lifespans (age 95 for single, and age 98 for couples). It is derived based on retirement projections for singles and couples at 67 years of age, with an additional $50,000 in personal items outside of super. Projections assume balanced investment profile with an annual investment return of 6.33%, 100% allocation of lump sum value to Account-Based Pension. Income is received from Age Pension (Centrelink) and Account-Based Pension to fund shortfall to income goal. Living costs and lump sum values are consolidated for couples. Figures are shown in today’s dollars by adjusting for 3% annual inflation.

The Association of Superannuation Funds of Australia (ASFA) develops guidelines to objectively outline the retirement budget needed by the average Australian to fund a comfortable standard of living in their post-work years.

As of the September 2025 quarter, ASFA estimates that Australians aged between 65-84, who are in relatively good health, will need the following weekly and yearly budgets2:

| Comfortable lifestyle (homeowners) | Modest lifestyle (homeowners) | Modest lifestyle (renters) | |

| Single (per week) | $1,039 | $674 | $951 |

| Couple (per week | $1,465 | $974 | $1,285 |

| Single (per year) | $54,240 | $35,199 | $49,676 |

| Couple (per year) | $76,505 | $50,866 | $67,125 |

Modest lifestyle: Covers basic living costs and a few extras – better than just the age pension.

Comfortable lifestyle: Allows for a good standard of living, social activities, and some travel (yes, even the occasional international trip!).

Renting in retirement: For renters, a “modest” standard of living is used, as it more accurately represents the typical lifestyle for those who haven’t purchased a home during their working lives3.

Tip: Everyone’s ‘comfortable’ looks different. Use these numbers as a guide, then tailor your plans to your own goals.

What are your retirement lifestyle expectations?

Ultimately, how much money you'll need for your own retirement is very personal, and will depend on your own situation, wants, needs and lifestyle expectations. It may help to factor in your day-to-day spending habits, your recreational activities and hobbies and whether you’ll be entering retirement debt-free. The following figures are a guide taken from the ASFA retirement standard for couples4.

| Comfortable lifestyle (homeowners) | Modest lifestyle (homeowners) | Modest lifestyle (renters) | |

| Housing (per week) | $159 | $146 | $457 |

| Health (per week) | $226 | $115 | $115 |

| Leisure (per week) | $344 | $189 | $189 |

| Clothing (per week) | $54 | $54 | $41 |

| Energy (per week) | $65 | $56 | $56 |

| Food (per week) | $261 | $215 | $215 |

| Transport (per week) | $193 | $116 | $115 |

| Household goods (per week) | $101 | $47 | $47 |

| Mobile and broadband (per week) | $58 | $45 | $45 |

NB: For retiree couples aged 65-84. Numbers are weekly, except where otherwise specified. Totals may not exactly equal the sum of components due to rounding of price adjustments.

How long will you work for?

The age at which you retire can have a significant impact on how much money you have and how much money you need in retirement. It can depend on factors such as your health, debts, super balance, age you can access your super, whether you have dependants, and your partner’s retirement plans (if you have one).

How long will you be retired?

Keep in mind that if you're planning to retire at around age 65, it’s likely you’ll live for another 20 years or so. According to a life expextancy report by the Australian Institute for Health and Welfare, men aged 65 in 2023 can expect to live to 85 years, while women can expect to live to 87 years5.

How much money will you have in retirement?

The money you use to fund your life in retirement will likely come from a range of different sources including the following:

Superannuation: Knowing your super balance is a crucial part of planning for retirement, as it's likely to form a substantial part of your retirement savings.

Age pension: Depending on your circumstances and assets, you could be eligible for a full or part age pension, or alternatively, may not be eligible for government assistance at all. If you are an AMP Super member, you can also take advantage of solutions like AMP Super Lifetime Boost, which is designed to provide you with a regular income for life, on top of your super and any age pension, so you can enjoy greater financial confidence and security throughout retirement.

Investments, savings and inheritance: You may be planning to downsize your house, sell shares or an investment property, or use money you’ve saved in a savings account or term deposit to contribute to your retirement. Or perhaps an inheritance or the proceeds from your family’s estate may help you out in your later years.

How our retirement calculators can help

Meet Mac. He’s 51, married and planning to retire at age 65.

To work out how much Mac might need in retirement, he tries our Retirement Needs calculator. Mac is hoping for a comfortable standard of living in retirement, and our calculator estimates this will cost him $1,154.49 a week – or $60,033 a year. He’s also planning on buying a new car and doing some travelling once retired, and thinks he’ll need $40,000 for these one-off expenses. Based on a life expectancy of 81 years, our retirement needs calculator estimates he’ll need a total of $993,473 to fund his retirement.

So how much might he have in retirement, and how long is his money likely to last, based on his current and expected financial situation?

Mac uses AMP’s Retirement Simulator to find out. Mac currently has $172,000 in superannuation invested in a balanced investment option, an annual pre-tax salary of $82,000, shares worth $20,000, and the couple owns their family home. Based on this information, our retirement simulator calculates he’ll retire with savings of $294,944. Based on his expected expenditure in retirement outlined above, our retirement simulator estimates his money will only last until age 71, leaving him with a funding shortfall of 10 years in retirement.

While this news may seem scary, it’s not an uncommon situation. Luckily, finding out about the possible shortfall now means there may still be ways to boost his savings before retirement.

What do you do if you won’t have enough to retire?

If, like Mac, you’re facing a shortfall in retirement, there are several things you can do to get your retirement on track. You could consider boosting your super through additional contributions, delaying your retirement, adjusting your retirement lifestyle expectations, or selling other assets.

Simply by having an idea of your current and projected retirement savings, thanks to our retirement calculator and simulator, you could work to improve the situation. The earlier you start, the easier it may be for you to reach your retirement goals.

You may also like

-

Four ways to maximise your Self-Managed Super Fund (SMSF) Here are four practical tips that could help you unlock more value from your SMSF, from managing cashflow to exploring property investment. -

How to buy an investment property through a Self-Managed Super Fund (SMSF) Discover how buying an investment property through a SMSF could help boost your retirement savings. -

What is a Self-Managed Super Fund (SMSF) and is it right for you? Discover what a Self-Managed Super Fund (SMSF) is, how it works, and whether it’s the right move for your financial future.

Important Information

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N.M. Superannuation Proprietary Limited (N.M. Super) ABN 31 008 428 322 (trustee), which is part of the AMP group.

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

® SignatureSuper is a registered trademark of AMP Limited ABN 49 079 354 519.

Any advice and information is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature. It hasn’t taken your financial or personal circumstances into account.

Digital Financial Advice is available to eligible members of the AMP Super Fund.

It’s important to consider your particular circumstances and read the relevant product disclosure statement, Target Market Determination or terms and conditions, available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. You can also ask us for a hardcopy.

1 Source: AMP commissioned research in July 2025 of 2,000 Australians by independent research company, Dynata.

2 Retirement Standard, September Quarter 2025, Association of Superannuation Funds of Australia (ASFA)

3 Retirement Standard Summary, September 2025, Association of Superannuation Funds of Australia (ASFA)

4 Retirement Standard Budgets, September Quarter 2025, Association of Superannuation Funds of Australia (ASFA)

5 Deaths in Australia - Life Expectancy, April 2025, Australian Institute for Health and Welfare