Key points

Australia has been a relative laggard in the rate cutting process, compared to our global peers, because core inflation took longer to decline in Australia through 2024.

But, interest rates are likely to fall further this year and the growth threat from tariffs increases the need for rate cuts. We expect the cash rate to decline to 3.6% by the end of this year and to end the cutting cycle at 3.1%. This is higher than average interest rates in the decade prior to Covid.

But the large falls in global sharemarkets from US tariffs and the potential hit to global growth means that larger and faster rate cuts could occur in coming months and a 50 basis point rate cut can’t be ruled out at the May meeting.

Introduction

The Reserve Bank of Australia (RBA) started the interest rate cutting cycle in February, when it reduced the cash rate from 4.35% to 4.1% and held the cash rate steady at its April meeting. But further rate cuts are likely later in 2025. Economists and financial markets focus on month-by-month central bank meetings, but the trajectory and end point of interest rates matters significantly for holders of debt, especially mortgages. We look at the outlook for interest rates in Australia in this edition of Econosights.

The rate cutting cycle

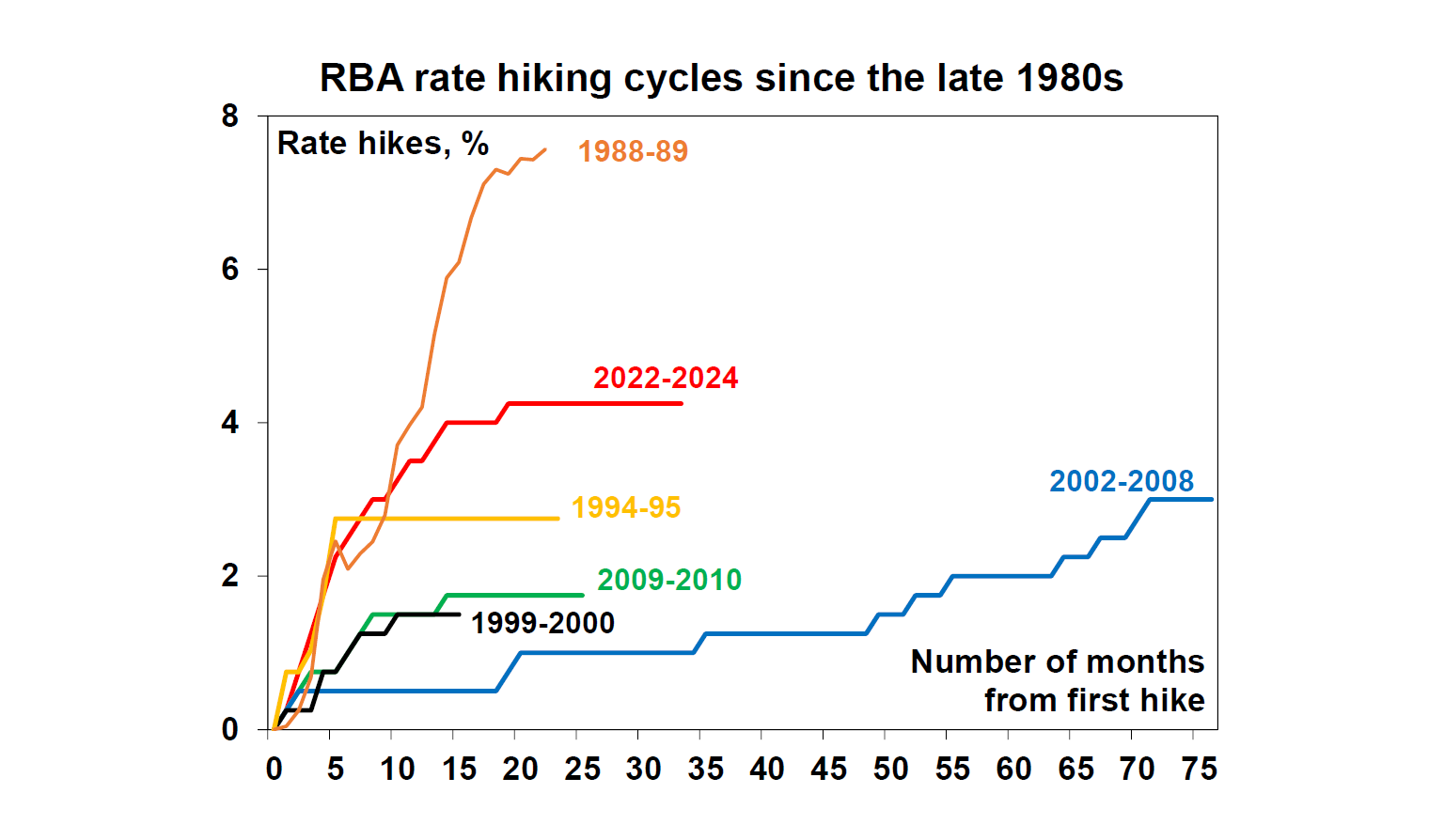

To understand the rate cutting cycle we first need to look at the hiking cycle. In the hiking cycle, the cash rate went from a record low of 0.1% in November 2020, to its highest level since 2011 of 4.35% in November 2023 where it remained until January 2025. By historical standards for Australia, this was the most aggressive hiking cycle since the late 1980’s (see the chart below).

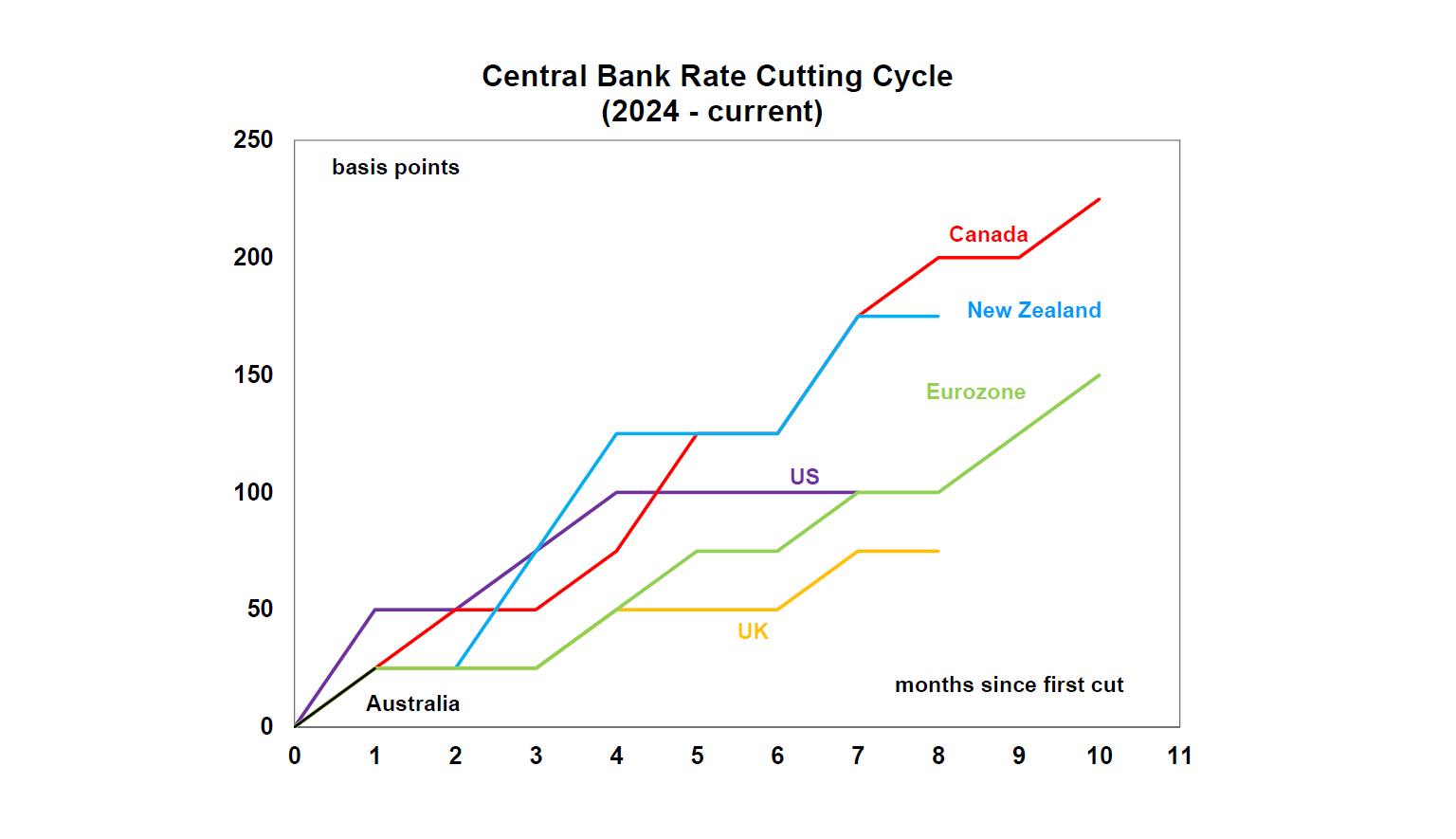

The cutting cycle began in February 2025 when the cash rate declined by 25 basis points from 4.35% to 4.1%. Compared to some of our peers, this has been a slower cutting cycle, with our peers all starting to cut rates in the second half of 2024, with the Bank of Canada reducing rates by 2.25%, the Reserve Bank of New Zealand by 1.75%, The European Central Bank by 1.5%, the US Fed by 1% and the Bank of England by 0.75%.

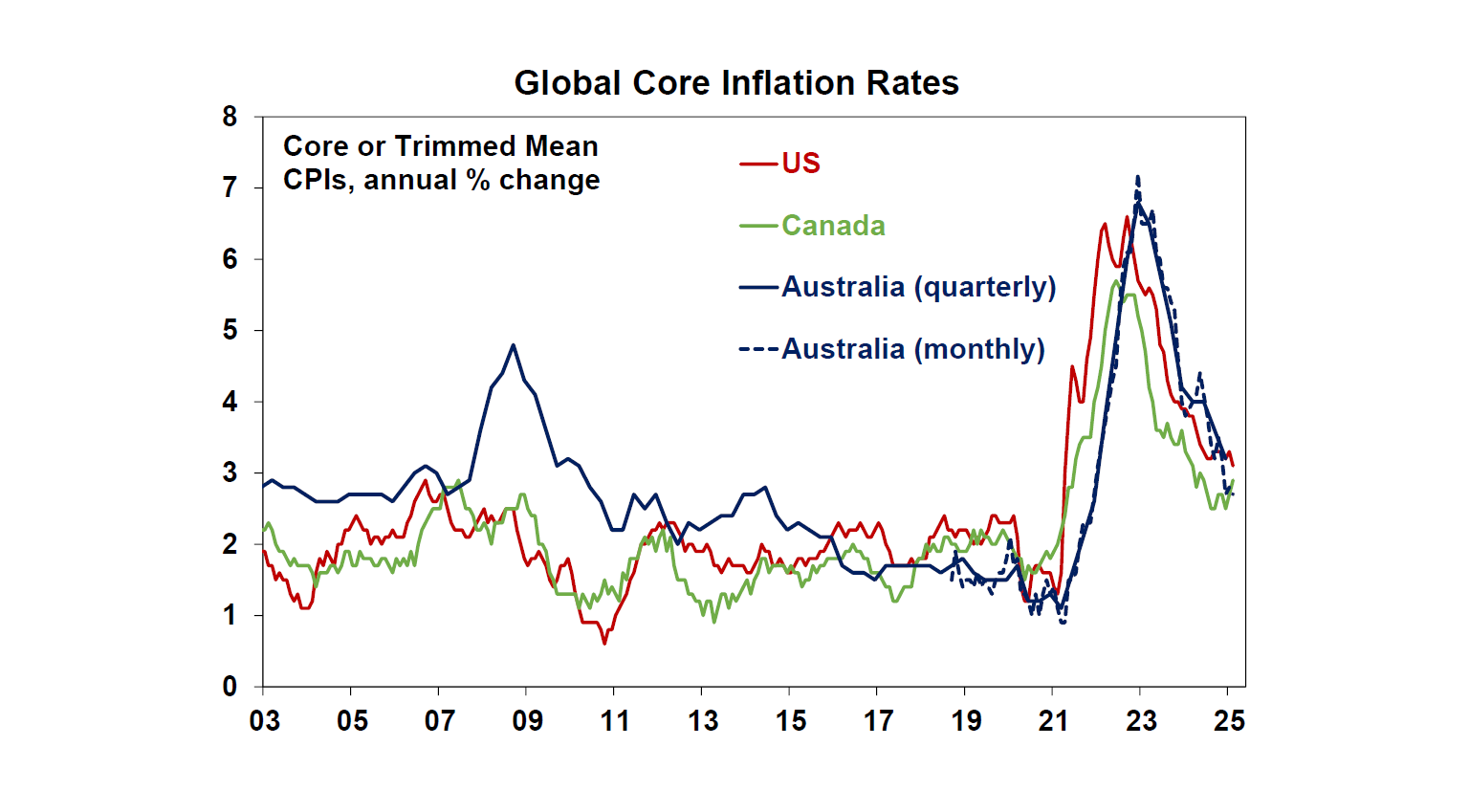

Why did the RBA lag its peers on reducing interest rates? The RBA has had more concern about the inflation outlook compared to global counterparts because Australia’s trimmed mean (or core) inflation figures were more elevated compared to its peers in the first half of 2024. The RBA became more comfortable with the inflation outlook in late 2024 when it was clear that core inflation was in line with global peers, which is the case now (see the chart below). This occurred because services inflation had started slowing, wages inflation had turned down despite the unemployment rate remaining low and the RBA got confirmation that it would be able get inflation sustainably into its target band within a reasonable time frame. Scenario analysis done by the RBA also indicated some concern that keeping interest rates high may have meant that inflation would have been too low eventually, undershooting the target band.

Where will Australian interest rates settle?

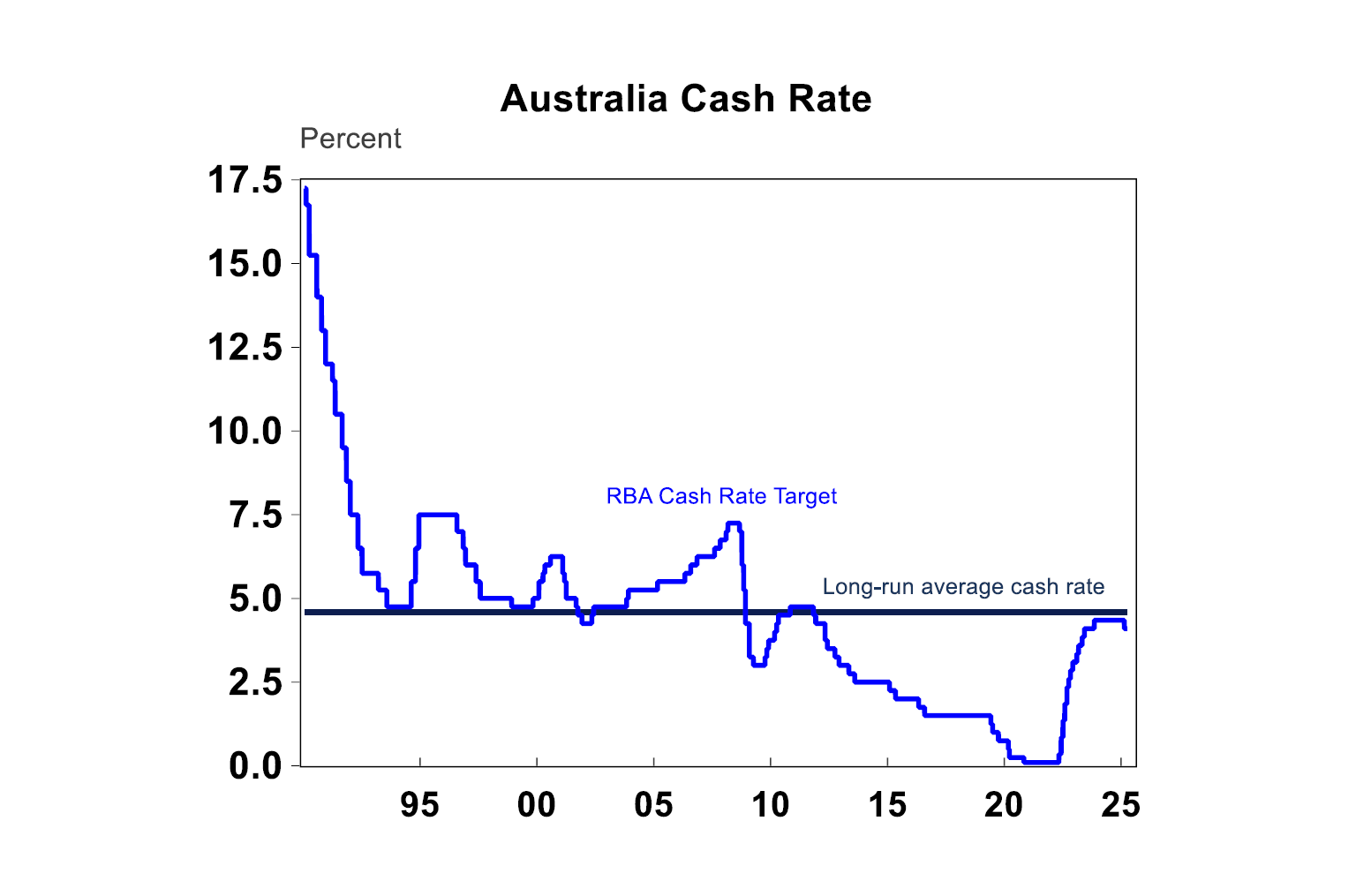

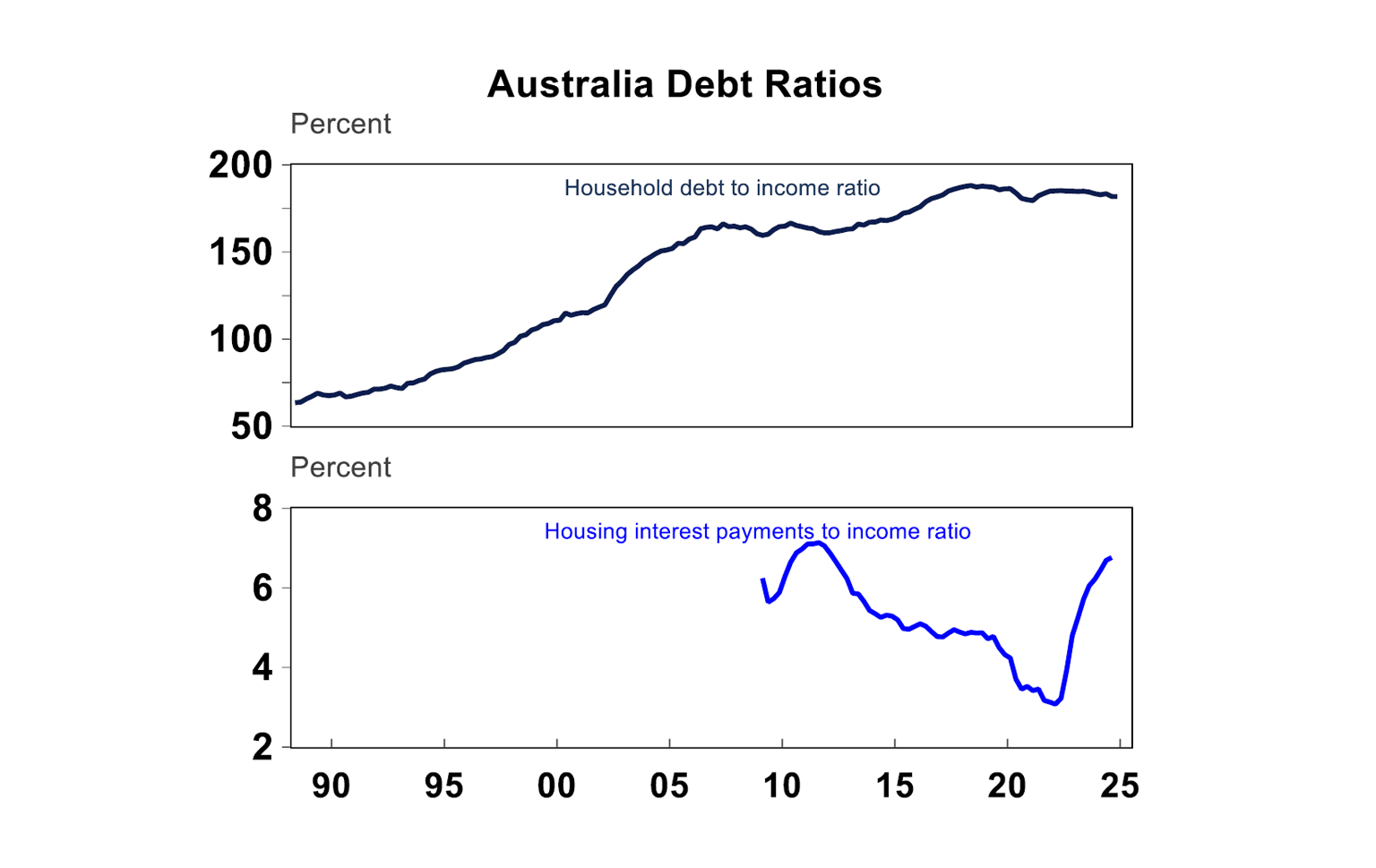

Since the RBA implemented inflation targeting in the early 1990s and started publishing an official cash rate, interest rates have averaged at 4.6% (see the chart below). Prior to the Global Financial Crisis in 2008, interest rates averaged at much higher levels compared to the years after the GFC, when persistent low inflation meant that interest rates had to be kept at low levels. The high interest rates of the years prior to the GFC are unlikely to be repeated for now because the structure of the economy has fundamentally changed, particularly as it relates to household debt.

Household debt-to-income levels is at 182% in Australia, down from its 188% peak in 2018 but well above pre-2008 levels of ~165%. This means that household debt repayments will run at an elevated level of income from here, despite interest rates being lower compared to their long-run levels.

When considering where interest rates will settle, it can be useful to consider Australia’s “neutral” interest rate which is the level of the cash rate that will “neither stimulate not restrain demand” (according to the RBA). According to recent RBA estimates and subsequent analysis done by CBA, this is somewhere around 2.9%, which is down from prior estimates of 3.5%. As the neutral interest rate has fallen, the current level of the cash rate (at 4.1%) remains at a restrictive level for the economy, which makes sense as GDP growth has been poor at ~1% over the past 4 quarters, with particular weakness in the consumer. The level of the “neutral” interest rate is a bit academic though because it is not directly observable and is subject to change. So, it does not mean that interest rates will settle at the level of the neutral cash rate, it just means that interest rates do have further to fall from here, to move out of being highly restrictive for the economy. We expect another 25 basis point rate cut in both May and August this year, with the cash rate ending 2025 at 3.6% before eventually declining to 3.1% in 2026 based on our inflation and growth forecasts. But, if the hit to Australian growth and financial markets is larger than expected from US and reciprocal tariffs, we may see a faster and more aggressive cutting cycle this year, with potentially 4 more rate cuts this year alone and a 50 basis point rate cut can’t be ruled out at the May Board meeting, as a form of insurance against any recession risks.

What is the impact of rate cuts on the economy?

Interest rates impact the economy in several ways. The RBA sees the policy transmission as working through 4 main channels: savings and investment, cash flow, asset prices and wealth and the exchange rate.

The savings and investment channel will:

- Reduce the rate on bank deposits, decreasing the incentive to save and encourage households to purchase goods and services.

- Encourage more borrowing by reducing repayments on loans for households and businesses, with the main impact on households.

The cash flow channel will:

- Increase cash flow in parts of the economy through the reduction in repayments on debt but also reduce some cash flow, as those reliant on deposits will have less income flowing. However, given that household liabilities are 2x deposits, cash flow will increase from lower interest rates.

- The asset price and wealth channel is likely to benefit from lower interest rates as asset prices tend to perform better in a lower interest rate environment (due to the discounted value of future income being higher).

- The impact of the exchange rate channel is likely to be more neutral in this cycle. Australia’s rate cutting cycle is likely to be less than its global peers which would usually put upward pressure on the $A but US tariff policies and concern over global growth are more likely to see the $A under pressure.

There has been some impact from the February rate cut already in the data, with consumer sentiment rising and home prices (especially in poor performing markets) improving. However, 1 rate cut is not enough to cause a significant rebound in consumer spending, so more time (and more rate cuts) is required to see a sustained turn around in activity.

Implications for investors

We see interest rates reaching 3.1% at the end of the cutting cycle, which is higher than the average level of the cash rate in the decade prior to the pandemic. This means that mortgage rates have more downside, but don’t expect huge falls to borrowing rates. This is because inflation is likely to settle towards the top end of the RBA’s target band due to: a larger government sector, more spending on defence and therefore larger budget deficits, an aging population (and a rising dependency ratio which drains national savings) and a less globalised world leading to higher prices.

US policies around tariffs do not have a large direct impact on Australian inflation. Less than 5% of Australia’s goods exports go to the US and Prime Minister Albanese has said that Australia will not retaliate with direct tariffs, which will keep a lid on imported inflation. Australian GDP growth may slow a little if lower global trade growth harms Australian exports to non-US countries. There may also be cheaper global goods coming into the Australian market, if prior exports to the US get rerouted to countries like Australia which could see lower inflation. This will support the RBA further cutting rates this year. The RBA may be forced to be more aggressive in reducing interest rates in the short-term if the threat to global growth worsens, the hard data deteriorates and there is a clearer sign of a recession or turmoil in financial markets. But the triggers for this scenario have not been met yet, although we are getting close and money markets are starting to price in this risk.

Diana Mousina

Deputy Chief Economist, AMP

Important note

While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance.

This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.