Simulate your retirement

Retirement Simulator

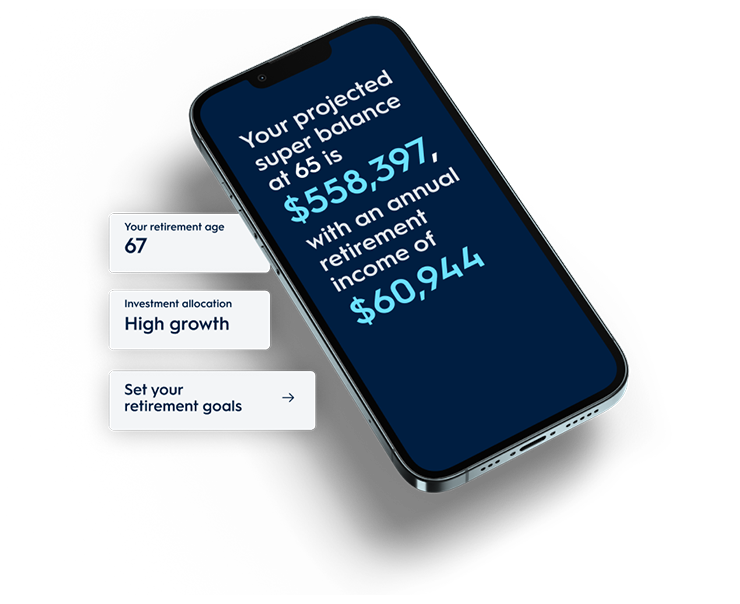

Our Retirement Simulator lets you see how different choices like adding the Lifetime solution might impact how much income you have in retirement and how long your money may last.

Key takeaways

Not sure how much super you're likely to have when you retire, or whether it’ll be enough to fund your dream lifestyle? You’re not alone. In fact, according to AMP research, nearly two in five Australians under 50 wish they’d started thinking about retirement in their 20s1.

The good news is you can get a clear snapshot of how you're tracking today and make any adjustments needed for the future. In just a few minutes, AMP’s Retirement Simulator shows your projected super balance, estimated future income, and how long it could last. It even highlights how Lifetime solutions like the award-winning AMP Super Lifetime Boost could maximise your future income, with no extra effort or fees.

Depending on your age, retirement may feel like a long way away. So why should you be thinking about it now? Maybe you’re juggling rent, mortgage payments, or saving for your next holiday – so your super probably isn’t top of mind.

But starting now can make a big difference in the long run. Time is your greatest asset when it comes to super. The longer you leave your money sitting in a super fund with strong returns, the more it can grow through the power of compounding returns. Even small actions today, like reviewing your investment options or making the most of your fund’s features, could help set you up for a better future.

Knowing how much super you should have for your age and where you stand today gives you time to take action, adjust your strategy, and grow your savings while you’re still in your prime earning years.

Making the right investment choice can help with your retirement goals. Growth investments can be a good fit for those with an investment timeframe of more than 10 years, aiming to achieve returns and are comfortable with some volatility and medium risk to get there. It gives more flexibility for calculated risks that could pay off later. To help decide what investment approach might suit you, it’s a good idea to speak to a financial adviser – AMP Super members can access personal Digital Financial Advice with no extra fees to help make this decision easier.

Of course, the right approach is goal dependent – when you want to retire, how much you’ll need, and your attitude to risk. But thinking about these things now, including how much money you might need in retirement, can help you plan for the lifestyle you want in the future.

But how do you figure out if you’re on track? That’s where AMP’s Retirement Simulator comes in. Answer a few quick questions and it will give you a tailored projection in just minutes, with insights into how your super is tracking, your estimated retirement balance and how long your money might last.

It also shows you how the Lifetime solutions such as AMP Super’s Lifetime Boost could help turn your super into a higher overall income stream in retirement that lasts for life. You can even experiment with your retirement projection by adjusting your goals to see how the choices you make today and in the future can create different outcomes.

You can explore how AMP’s Lifetime solutions could increase your retirement projection by toggling the feature in AMP’s Retirement Simulator. Displayed in an easy-to-understand graph, it shows how this award-winning feature could potentially add years of extra financial support, helping you enjoy a better retirement. Curious to know how it works? In a nutshell, it works automatically in the background to boost your Age Pension eligibility by changing how your super is assessed.

At 30, Eve, a single homeowner earning $75,000 a year with $50,000 in her AMP Super account, has the Lifetime feature automatically added to her super. This move gives her a head start on building choices for retirement.

By 65, her super has grown to $498,000, and she chooses to split it evenly between an AMP Lifetime Pension and an Allocated Pension.

Thanks to having the Lifetime Boost feature from age 30, only $31,000 of the $249,000 in her Lifetime Pension is assessed by Centrelink for Age Pension eligibility.2

It’s calculated using a discounted purchase price that accounts for contributions, deeming rates and asset test discounts. This means Eve may be eligible for more Government Age Pension, giving her greater income in retirement, for longer.

You can play around with AMP’s Retirement Simulator to see your projected super balance and how lifetime solutions such as AMP Super’s Lifetime Boost could help amplify it. You’ll just need a few basic details to get started:

1. Your age

2. Your current super balance

3. Your annual income (before tax)

4. (Optional) Your partner’s details for a combined projection

5. (Optional) Other assets like shares, investments or property

1 Source: AMP commissioned research in July 2025 of 2,000 Australians by independent research company, Dynata.

2 These cases are provided for illustration purposes only to help you understand how the Lifetime feature works and are not intended to replace financial advice. This information doesn’t represent the benefits that you could receive, and the outcome will depend on your personal circumstances. This information is based on superannuation, tax and social securities laws (including deeming rates) at the time of preparing the case studies. Government policies and laws will change in the future, which may impact this feature, and the benefits discussed.

Products in the AMP Super Fund and the Wealth Personal Superannuation and Pension Fund are issued by N. M. Superannuation Proprietary Limited ABN 31 008 428 322 (NM Super), who is part of the AMP group.

AMP Super refers to SignatureSuper® which is issued by N.M. Superannuation Proprietary Limited ABN 31 008 428 322 AFSL 234654 (NM Super) and is part of the AMP Super Fund (the Fund) ABN 78 421 957 449. NM Super is the trustee of the Fund.

Any advice and information is general in nature. It hasn’t taken your financial or personal circumstances into account. You should seek professional advice before deciding to act on any information in this article.

Digital Financial Advice is available to eligible members of the AMP Super Fund.

It’s important to consider your particular circumstances and read the product disclosure statement (PDS) and Target Market Determination (TMD) for AMP Super (SignatureSuper), available from AMP at amp.com.au, or by calling 131 267, before deciding what’s right for you.

You can read our Financial Services Guide https://www.amp.com.au/financial-services-guide online for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services it provides. You can also ask us for a hard copy. All information on this website is subject to change without notice.

The AMP Lifetime Pension is not currently available but is expected to be available in 2026. The issuer of AMP Lifetime Pension is NM Super. The TMD and PDS for AMP Lifetime Pension is expected to be available in mid-2026 on www.amp.com.au/resources#pds. Please review the PDS before deciding to acquire or hold the Lifetime Pension as there may be features or conditions of the Lifetime Pension that may not be suitable to you. NM Super may withdraw or change the Lifetime pension in the future and therefore these benefits may not apply.