Get a guaranteed return on your lump-sum in a timeframe that suits you.

Features

Be sure of the interest you’ll earn and lock in a great rate. Invest from $5,000 to $10,000,000.

Choose from three months to five year terms and multiple interest payment options to suit your needs, and it’s simple to roll over.

Every dollar you put into your account will help your savings grow.

We’re an award winning bank in the term deposit category, so you can enjoy peace of mind knowing AMP Bank term deposits work harder for your savings.*

Your deposits are safe with us. You are protected under the Australian Government guarantee for combined deposits up to $250,000 per customer if a financial institution fails.

Product inclusions

How term deposits work

If you’ve received a lump sum of money you’re keen to put away, or you’re saving for something big, a term deposit might be suitable for you.

It can be an ideal way to save for a specific goal, as it enables you get a guaranteed return based on the amount you invest and the interest rate on the day you open your term deposit.

Leaving your money in a transaction account generally earns you little or no interest. You may also be tempted to spend it. Instead, consider putting those funds away for a set period of your choice that pays you a guaranteed return at the end.

Whether you want to put down a deposit on a new home, buy a car or start a family, a term deposit could help you achieve your goals faster.

It's important to think carefully when choosing your term duration as you need to provide 31 days' notice1 if you want to access the money earlier than the selected term2. If you choose to continue your term deposit at maturity (rolling-over), the interest rate on the day the roll-over occurs will apply, this may be different to the interest rate for your initial term. Talk to a financial adviser to see what kind of saving strategy works best for you.

Choose the right term deposit

For instance, we currently offer:

| % pa | for deposits over $25,000 for a term of 6 months |

| % pa | for deposits over $25,000 for a term of 12 months |

| % pa | for deposits over $25,000 for a term of 5 years |

Rates effective . Please check out the full range of term deposits and interest rates.

Changes to interest adjustment for early withdrawal

If a term deposit is withdrawn early, the interest rate that applies to your account will be reduced by the interest rate adjustments shown in the tables below.

Early withdrawal for all customers except AMP Super Fund

| Portion of term completed | Interest rate adjustment (% reduction to your interest rate) |

| Less than 20% | 90% |

| 20% to less than 40% | 80% |

| 40% to less than 60% | 60% |

| 60% to less than 80% | 40% |

| 80% or more | 20% |

Early withdrawal for AMP Super Fund

| Portion of term completed | Interest rate adjustment (reduction to your interest rate pa) |

| Less than 25% | 2.75% pa |

| 25% to 50% | 2.25% pa |

| 50% to 75% | 1.75% pa |

| 75% to 90% | 1.25% pa |

| 90% or more | 0.75% pa |

If the original interest rate, before any adjustment is made, is less that or equal to the applicable interest rate adjustment percentage, no interest will be paid.

Full details of the changes are in the Deposit products fees and charges guide and the Deposit products terms and conditions. Please take the time to read the document at amp.com.au/bankterms.

Boost your savings with certainty

Who can open an account?

We’re currently accepting online applications for Personal and Sole Trader accounts only.

For all other entities, including Self-Managed Superannuation Funds and Companies, please speak to your Adviser or Fixed Income Broker.

Be alert

A number of online scammers posing as trusted financial institutions are on the rise. You can only apply for AMP Bank Term Deposits via this web page or through an adviser.

If you’ve been asked to deposit money to an account, or received an email or call promising special rates or asking you to apply, contact our team immediately on 13 30 30 option 5. Do not reply to or click on any links in a suspicious email or SMS. Remember AMP Bank will never send you an email or SMS asking for your personal or banking information.

Documents & downloads

FAQs

Applying for a term deposit

What do I need to apply?

Applying online will take you between 10-15 minutes. You can open a term deposit online under a personal or joint account name. To do so, you need:

- To be 18 years or over

- To be an Australian permanent resident with an Australian residential address

- A minimum deposit of $5,000

- 2 forms of ID which can include your passport, Australian driver licence or Medicare card

- Your Tax File Number (TFN) or TFN exemption handy. You don’t have to provide your TFN or exemption to your Term Deposit but, by law, we have to withhold tax if you choose not to

- Your bank account details for the initial deposit

Short term and long term deposits explained

| Short Term | Long Term | |

| Term Interest Rate | Less than 1 year Lower interest rate is offered |

1+ years Higher interest rate is offered |

| Interest Payment Options | Paid at maturity

NOTE: in some cases it is possible to receive interest more frequently. Please see T&Cs for more information |

*The interest rate is reduced, if one of these interest payment options is selected.Suitable for |

| Suitable for | Easier access to funds | Long term savings goals |

How can I choose when my term deposit matures?

You can provide AMP with maturity instructions while applying for your term deposit. We may also write to you before your term deposit matures to confirm your instructions. The length of the term can vary from one month to five years. The interest rate will change depending on factors including how much you are depositing, the term you select and how often you choose to have interest paid. Please check out the full range of term deposits and interest rates.

What are the fees

There are no ongoing account management fees. If you want to access your money before the end of your term, interest rate adjustment may apply. Read our Deposit products fees and charges guide for more information.

Account Information

How do I access my account information after applying for a term deposit?

Your term deposit investment certificate will be issued on the day the account is opened. It contains your term deposit details including your term deposit account number and rate and should be received in standard postal times.

Once your Term Deposit has been established, you will be sent a letter by standard post which contains your account information. If you have also opted to receive electronic communications, you will also receive an email with partial account information when your Term Deposit is established. This email does not include your full account number.

How can I change my maturity instructions or reinvest my term deposit?

You can fill out the Term Deposit reinvestment or change of instructions form and send it back to us. Please see our Terms and Conditions for more information.

What if I am in hardship and need to break my term deposit?

If you are in hardship, you can fill out the Hardship Assistance Information form and we will review on a case by case basis. If we approve the request, you do not have to provide us with 31 days’ notice of early withdrawal, and there may be Interest Rate Adjustments.

I have just opened a term deposit, why can’t I register for internet banking?

After registering for a term deposit, an account number will be generated and provided to you separately in the mail by post. You can then use that account number and your mobile number to register for internet banking.

Can I open a joint bank account?

Yes. Joint accounts can be set up during the application process. Joint account holders can individually or jointly transact and make changes to the account.

Can I withdraw funds from my term deposit account?

Funds may be withdrawn on maturity and will be electronically paid to the nominated bank account. If no instructions are received by the maturity date, your term deposit will automatically roll over for the same term at the applicable interest rate offered on that maturity date.

Interest Payments

When will I receive interest payments from my term deposit?

Depending on the term, interest payment frequency can be monthly, quarterly, semi-annually, annually or at maturity.

Debits

How do I make deposits to my term deposit account?

For term deposits, you may deposit funds into your account only at the time your account is opened, or when you elect to roll your term deposit over at the maturity date. Other than at these times, you cannot make any additional deposits to a term deposit. Read our Deposit products terms and conditions for more information.

When is my external account debited after opening my term deposit?

The day you receive your confirmation email is the day we attempt to pull funds from your external account. Please make sure that there are sufficient funds for the transaction to be successful.

What if my account doesn’t have the funds available when you attempt to direct debit?

The transaction will be dishonoured, at which point the funds are returned and your term deposit account is closed. Please make sure that there are sufficient funds for the transaction to be successful. If it is not successful, the interest rate may change.

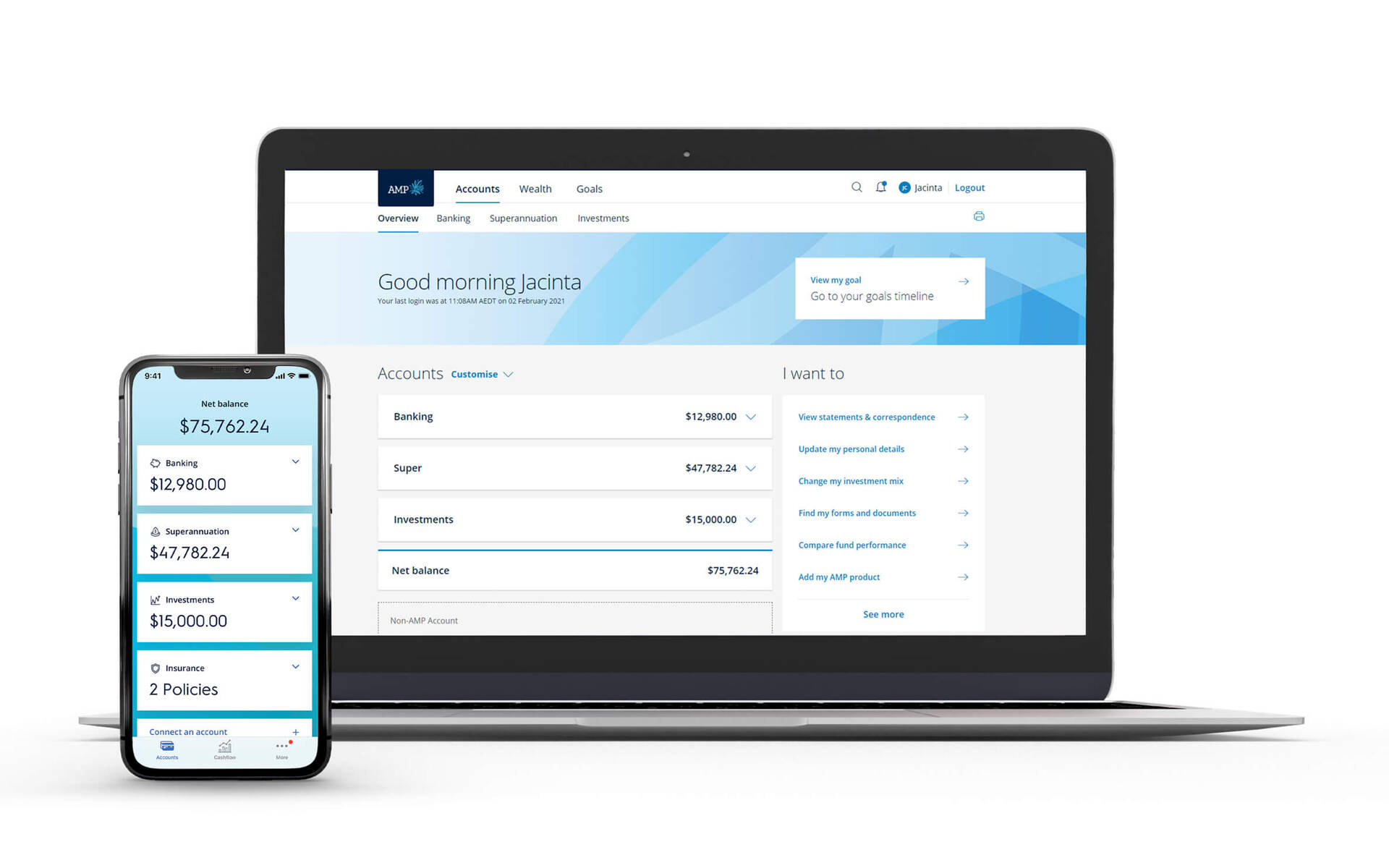

How to manage your Term Deposits

To change instructions on your Term Deposit:

- Log in to My AMP

- Select the Term Deposit you want to manage

- Choose ‘Change or Break my Term Deposit’ on the ‘I want to’ menu

- Select and complete from the following options:

- Reinvest with the same term and interest payment frequency

- Change the term and/or interest payment frequency

- Withdraw funds at maturity

- Add funds at rollover

- Early redemption/Break Term Deposit

Your term deposit maturity instructions will be displayed in My AMP.

You can also change your maturity instructions by completing the form Change Term Deposit maturity instructions and send it back to us. Please see our Terms and Conditions for more information.

Contact us

Mon - Fri: 8am – 8pm (AEST)

Sat & Sun 9am – 5pm (AEST)

Important information

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

It’s important to consider your circumstances and read the relevant Product Disclosure Statement or Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account. Information including interest rates is subject to change without notice.

Any application is subject to AMP Bank’s approval. Terms and conditions apply and are available at amp.com.au/bankterms or 13 30 30. Fees and charges may be payable. Full details are available in the Fees and charges guide.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.

* For more information about these awards please visit Mozo Experts Choice Awards, RateCity Gold Awards, Money magazine Best of the Best 2022 Awards, Money magazine 2022 Consumer Finance Awards and Money magazine Best of the Best 2023 Awards.

Information including interest rates is correct as at and is subject to change without notice.

1 Excludes AMP Super Fund.

2 Interest adjustment applied when accessing funds earlier than the selected term.