Features

Earn a total ongoing variable rate of up to % pa1 by depositing $1,000 in the previous month into your AMP Saver Account.

Every penny counts, so we don’t charge any monthly management fees on your AMP Saver Account.

Get access to a Visa Debit Card and digital wallet by opening an AMP Access Account at the same time.

Product inclusions

Rates & eligibility

Current rates

Effective date

| % pa standard rate | + % pa Deposit Bonus Interest Rate | = % pa total rate1 |

| This is the ongoing standard variable rate on all balances. | This is the ongoing bonus variable rate when you deposit $1,000 in the previous month. Payable on balances up to $250,000. | This is the total variable rate which applies to balances up to $250,000, made up of the standard rate and the Deposit Bonus Interest Rate (subject to eligibility). |

An added bonus of 0.00% pa

For existing AMP super, pension or investment account holders

If you hold an eligible super, pension or investment product, you may also be eligible for an additional Wealth Bonus Variable Interest Rate of 0.00% pa on balances up to $250,000.

This will be paid on top of your applicable standard and Deposit Bonus Interest Rate, taking your total interest payable to % pa.

To get the added Wealth Bonus Interest Rate, you must be able to view both your AMP Saver Account and AMP Wealth product together in the same My AMP login.

For more details, including a list of eligible super, pension or investment products, check out our eligibility info page.

How is interest calculated?

If you are eligible and deposit $1,000 into your AMP Saver Account in the previous month, you'll earn the Deposit Bonus Interest Rate during the current month on top of the standard rate, and the total rate will be paid the next month and is payable on AMP Saver Account balances up to $250,000 only.

For example, if you deposit $1,000 into your AMP Saver Account in October:

- You’ll earn your applicable bonus interest rate for November, on top of your applicable standard variable rate, with interest calculated daily.

- You’ll receive the interest payment into your account by 10 December.

Example:

$1,000 into your AMP Saver account in October

the Deposit Bonus Interest Rate during November on top of your standard rate, with interest calculated daily, on account balance up to $250,000

the interest payment into your account by 10 December

Documents & downloads

Get what you're saving for faster

FAQs

When will my interest get paid?

If you are eligible and deposit $1000 into your AMP Saver Account in the previous month, you'll earn the Deposit Bonus Interest Rate during the current month on top of the standard variable rate. You’ll receive the interest payment into your account the following month and is payable on AMP Saver Account balances up to $250,000 only.

An example of how it works:

| Deposit | Earn | Receive |

| $1,000 into your AMP Saver account in April | the Deposit Bonus Interest Rate during May on top of your standard rate, with interest calculated daily, on account balance up to $250,000 | the interest payment into your account by 10 June |

For more information, refer to the table in the AMP Saver Account Rewards Rules Handbook

Why is the Wealth Bonus reducing to 0.00% p.a.?

Following a product review, we've decided to reduce the rate to 0.00% p.a, effective 1 December 2023. We're doing this to make our product offering simpler and easier to understand.

How do you calculate the interest on the AMP Saver Account?

To calculate the interest on your AMP Saver Account you can refer to the table in the AMP Saver Account Reward Rules Handbook

What do I need to apply?

Applying online is easy and will only take you about five minutes to complete it. You'll need a valid form of identification, and your tax file number (if you wish to provide it). Providing this will prevent you from paying unnecessary tax on any interest you might earn.

The full list for identification can be found at amp.com.au/identification

What are the fees?

There are no ongoing account management fees or transaction fees. There are some fees and charges for special services and transactions that may apply.

Read our deposit product fees and charges guide for more information.

Do I get a debit card with my AMP Saver Account

The AMP Saver Account does not come with a debit card, this is an account designed for a savings purpose. You can link your AMP Saver Account to an everyday transaction account, like an AMP Access Account, which gives you access to a Visa Debit card.

Can I link my AMP Saver Account to an everyday transaction account?

Yes, you can. You can link it to our transaction account, the AMP Access account. By linking to the AMP Access account you will have access to Visa Debit card and the availability to make mobile payments with Apple Pay, Samsung Pay or Google Pay.

You can apply for both these accounts at the same time in the online AMP Saver application form.

Can I have multiple access accounts linked to my AMP Saver Account?

No, you can't but you can hold multiple access accounts and you can transfer money to and from your AMP Saver Account. You can also access all of these accounts in one view when you log into My AMP.

Can I set up a direct debit?

Direct debits can't be set upon your AMP Saver Account. If you'd like to set up a direct debit, you can do so from a linked transaction account like an AMP Access Account.

You can apply for both accounts at the same time in the online AMP Saver application form.

Read our Accounts Access and Operating Terms and Conditions for more information.

Can an AMP Saver Account be used for business purposes?

No, it can only be used as a personal account. We have a dedicated AMP Business Saver Account which can be used for business purposes, with quick access to your savings.

Are my savings secure?

You're protected under the Financial Claims Scheme (FCS). The Australian Government guarantees combined deposits up to $250,000 per customer, in the event a financial institution fails.

How can I view and track my savings?

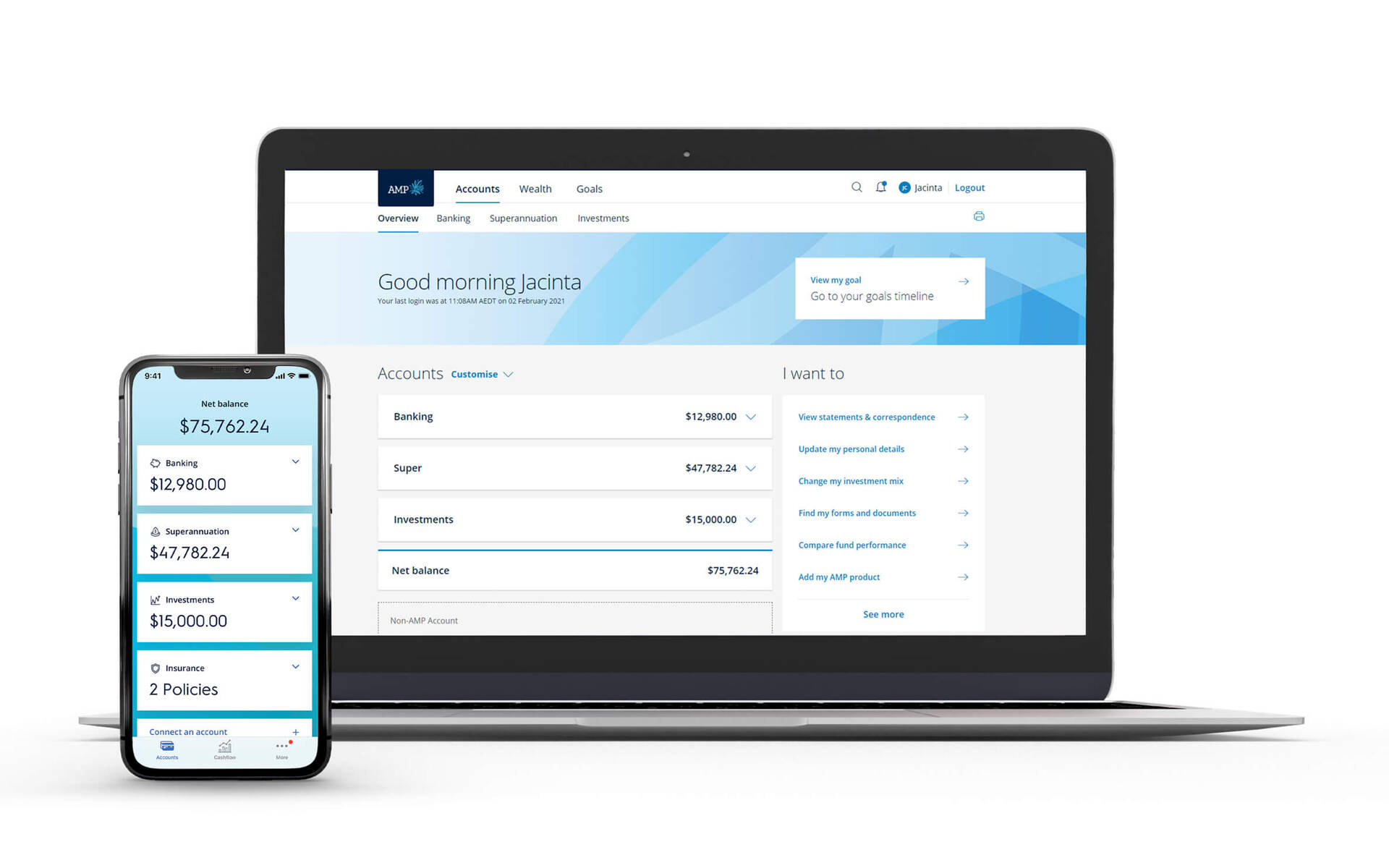

You can view and track your savings through My AMP. It is an easy and secure way to do your banking online on either your desktop or through the My AMP app.

Using My AMP you can access and manage all of your accounts in one place, where and when it suits you.

Contact us

Mon - Fri: 8am – 8pm (AEST)

Sat & Sun 9am – 5pm (AEST)

What you need to know

The product issuer of the AMP Saver Account is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517. Information including interest rates is subject to change without notice. Terms and conditions apply. Fees and charges are payable. Any application is subject to AMP Bank’s approval. Before making a decision about this product you should consider the AMP Saver Account terms and conditions available from AMP at amp.com.au/bankterms or by calling 13 30 30.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you. All information on this website is subject to change without notice.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

1 Up to % pa ongoing variable rate on balances up to $250,000 and is subject to change without notice. For Accounts opened from 1 April 2021, offer is limited to one account per person. For any portion of the balance over $250,000 and up to $5,000,000 the interest rate reverts to the AMP Saver Account standard rate only. The maximum ongoing balance per customer name is $5,000,000. Terms and conditions apply. Fees and charges are payable. Any application is subject to AMP Bank’s approval. A target market determination for this product is available at www.amp.com.au/bank/tmd.

* For more information about these awards please visit Mozo Experts Choice Awards, RateCity Gold Awards, Money magazine Best of the Best 2022 Awards and Money magazine 2022 Consumer Finance Awards.