Credit and deposit products are issued by AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

Information including interest rates is correct as at is subject to change without notice. Business Overdraft subject to AMP Bank credit approval. Terms and conditions and fees and charges apply.

Before making a decision about this product you should consider the Business Overdrafts terms and conditions available from AMP Bank at amp.com.au/appterms.

This information is provided by AMP Bank Limited. Read our Financial Services Guide available at amp.com.au/fsg for information about our services, including the fees and other benefits that AMP companies and their representatives may receive in relation to products and services provided to you.

AMP Bank is a member of the Australian Banking Association (ABA) and is committed to the standards in the Banking Code of Practice.

A target market determination for these products is available on our TMD page.

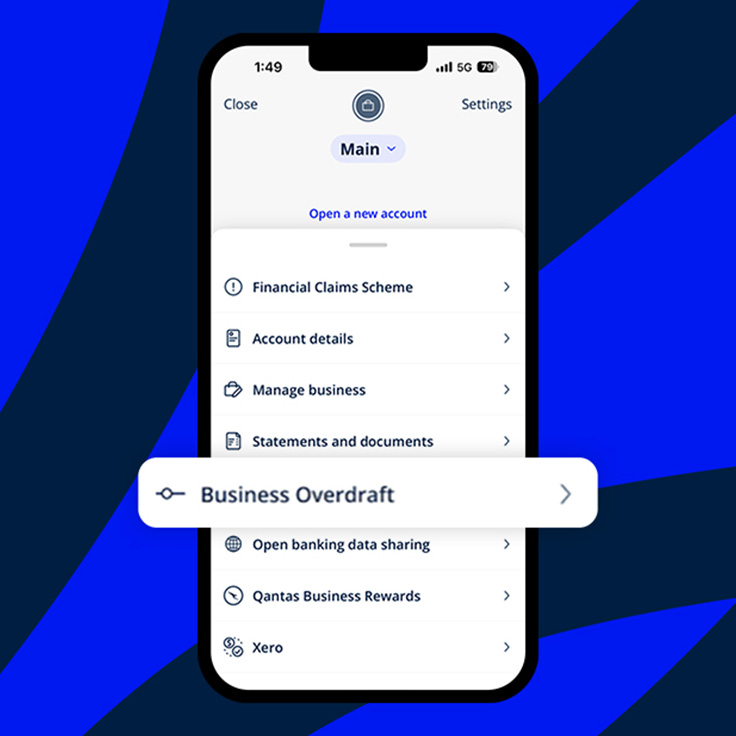

For accounts with BSB number 939 900, that you access via AMP Bank GO, the Terms and conditions that apply are available here.

For accounts with BSB number 939 200, that you access via the My AMP mobile app, the Terms and conditions that apply are available here.